Nonprofit Accounting & Financial Reporting

8.00 Credits

Member Price $324.00

Non-Member Price $384.00

Overview

Highlights

- Helpful cross references between original FASB Statements and the FASB Codification (ASC)

- Definitions of NPO's and Voluntary Health & Welfare Orgs.

- NPO transaction types and applicable accounting

- NPO financial statement requirements

- Highlights of the AICPA NPO A&A Guide

- Critical provisions regarding contributions, including gifts-in-kind

- ASC additions to the disclosure requirements for contributed personal services

- Functional expense reporting

- Transfers of assets to NPO's

- Accounting for activity of related foundations

- Consolidations

- Split-interest agreements

- Avoiding common NPO F/S problems

- Accounting and disclosures for endowments including UPMIFA

- Addresses the significant changes to NPO financial statements - ASU 2016-14. Also, includes example actual F/S.

- Covers ASU 2018-08 on Revenue Recognition for Contributions by NPOs, ASU 2019-03 on Collections, and ASU 2020-07 on Contributed Nonfinancial Assets

Prerequisites

Basic knowledge of NPO accounting and financial reporting

Designed For

Nonprofit finance officials and CPA’s who perform accounting and auditing services for NPO’s. Note: Attendees are encouraged to bring to the seminar relevant NPO F/S for their own reference during our discussion of key reporting requirements.

Objectives

To reinforce critical accounting and financial reporting principles for NPO’s and update participants on recent developments applicable to NPO’s and their auditors.

Preparation

None

Notice

• This event is paperless unless you elect to pay for printed materials. • All materials will be available to download in advance and participants will receive an email two days prior to the course date. Materials will also be posted in the “My CPE” section of the NESCPA website. • Parking and lunch are provided on-site

Leader(s):

Leader Bios

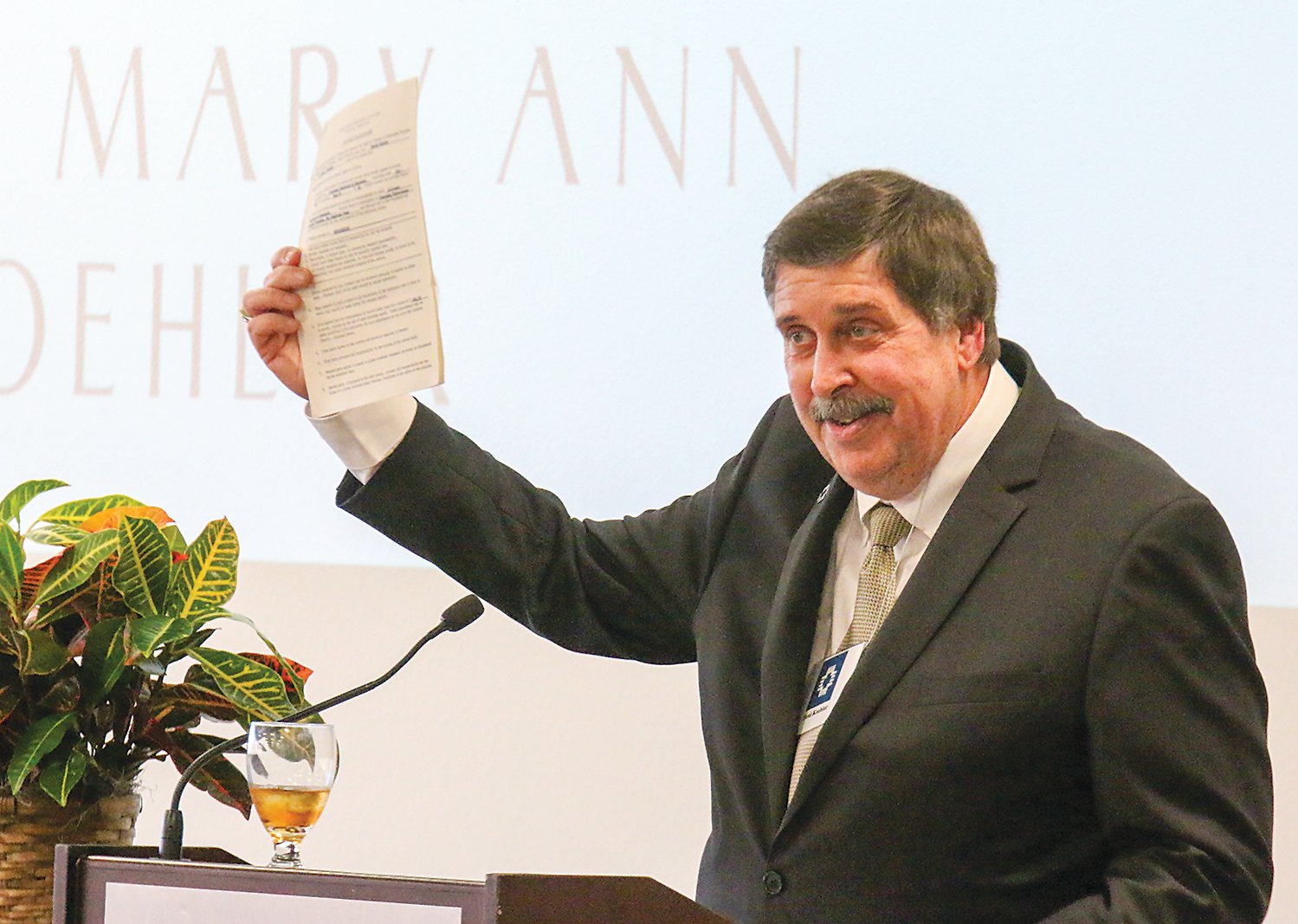

Paul Koehler, Paul H. Koehler, CPA

Paul H. Koehler, CPA, of Lincoln is a Government/Nonprofit Services Specialist,

providing auditing, training and consulting services to governmental and

nonprofit organizations and professionals nationwide. He is a member of

the AICPA, the Nebraska Society of CPAs and is a past president of the

Lincoln Chapter of the Association of Government Accountants. Koehler is

the Nebraska Society's representative to the Mid-America Intergovernmental

Audit Forum, and is a current member and past chairman of the

Nebraska Society's State and Local Governmental Accounting and Auditing

and Not-For-Profit Committees. A frequent speaker on not-for-profit

and governmental topics throughout the country, he has been honored by

the AICPA, many other state societies and the Nebraska Society for his outstanding skills as a

discussion leader.

Non-Member Price $384.00

Member Price $324.00